Then the budget arrived. Finance Minister Nirmala Sitharaman will present the budget for the eighth consecutive time on February 1. It took 6 months to make it and an entire 40 -day entire Parliament is the name of the Budget. After all, is this budget? How is it made? Where does the government come from and where does it go

,

Question 1: What is the budget? answer: The budget is the account of the government’s deposit and expenditure. As we do in our homes. That is, where will the money come from and where will it go? There is a small difference that there is usually a month accounted in the houses, but the government prepares the entire year’s account. At the same time, through his speech, the Finance Minister also explains the government’s economic policy as well as long -term and short term target. The funny thing is that there is no word called budget in our constitution. In the Constitution and Government Language, it is called Annual Financial Statement. The government is required to give account of its annual deposit and expenses to the Parliament, so the budget comes every year.

Question 2: Increase tax or take loan for income, spend on the bridge or increase salary, how do the finance minister decide? answer: Budget making no rocket science. Just keep in mind that the government has two pockets. First-Revenue and Second Capital. How and how much money will come in both these pockets and where will it go, this is the accounting in the budget.

Now the revenue and capital are understood by two keywords. Revenue Mane repeatedly i.e. repeat and capital Mane occasionally or non-repeat.

Think, repeated expenses are good, or sometimes solid expenses? Such as buying a car or automatic washing machine. Buying a plot or flat.

Clear, sometimes solid expenses are good. Automatic washing machine will save hard work and time. We can use this hard work and time to increase our earnings. The price of flat or plot will increase and this will make your property.

On the other hand, electricity bills, mobile bills, society maintenance are repeated expenses like maintenance, we want that the less such reports are as good.

Now the matter was earned …

The more time the earnings are exactly the opposite of expenses, the better. Think your salary started getting every week instead of every month. Or apart from salary, the rent of a flat purchased in Noida was also available.

Meaning it is clear that earnings should be repeated. Sometimes it is not right to earn non-relevant earnings. Don’t know never.

Just like this, the government also wants that its revenue in the pocket is as good as the money, such as the money from tax. But the government wants to minimize the repeat expenses incurred from Revenue Pocket. Such as the expenditure on salary-pension or subsidy of employees.

At the same time, the government spends more and more than capital pocket. That is, solid expenses that are not repeated like us. Which further increase earnings. Such as highways, airports and power houses.

But in terms of earnings, the government wants to depend at least on capital pocket. Such as non -reported earnings from debt or foreign grant. In the budget, the government creates balance between its revenue expenses and capital expenses, because it is not only possible to work by building bridges, highways and airports, it is necessary to give good salary and pension to people.

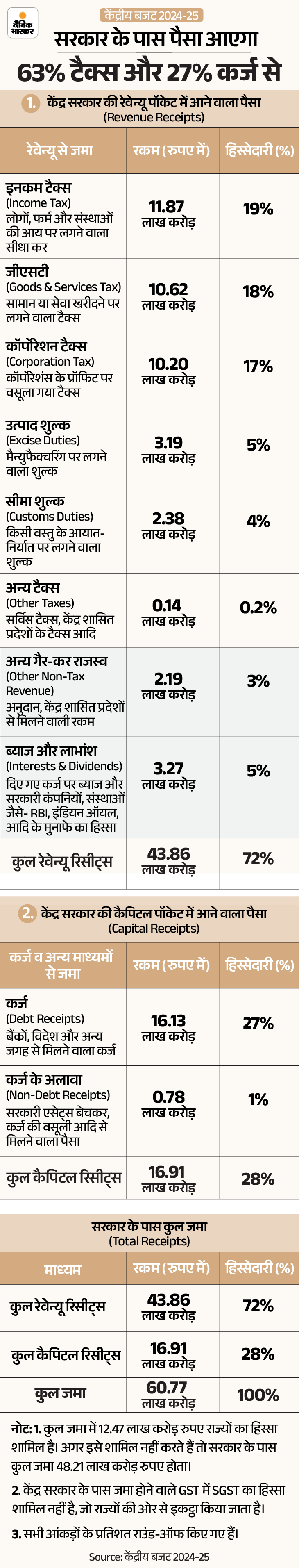

Question 3: Where does the money come from in both the pockets of the government and where does it go? answer: First of all, we know where the money will come from the government’s revenue and capital pocket in 2024-25-

Now know where the government’s money will go-

Question 4: Why is the account of governments called the budget? answer: Actually the story is 1733. England Finance Minister Sir Robert Walpal introduced the account of the government’s deposit in Parliament. Walpaul brought its documents into a small leather bag, called Bouge in French and Budget in English. From then on, the account was called a budget.

Question 5: When and how do the budget start? answer: The budget making begins in September or October, when the Department of Economic Affairs of the Finance Ministry sends a circular to all central ministries and departments. In the circular, estimates of expenditure are sought from all ministries. These include plans expenses on schemes in addition to routine expenses like salary-pension. Meanwhile, the Finance Minister also meets delegations of all stake holders like farmers and industrialists. In this way, after finding out information and needs from many sources, the government introduces its expenses and deposits. As soon as a raw blueprint of the budget is ready, the Finance Minister meets the Prime Minister about it. There are frequent changes on the Prime Minister’s advice. In this way the final draft of the budget is formed which is printed on the printing press of the Ministry of Finance. A copy of the same budget will be presented in the Lok Sabha on 1 February and the rest of the MPs will be given soft copy through the tab.

Question 6: What happens other than the Finance Minister’s speech on Budget Day? answer: After the budget speech of the Finance Minister in the Lok Sabha, general discussion on the budget begins. After this, three more bills are introduced-

- Vote on Account: It takes time to pass the budget by May. While the cycle of government budget is till 31 March. In such a situation, the government withdraws money for the expenses of April and May. This is not discussed in Parliament.

- Application Bill: It has the details of the government’s expenses. Through this, the government gets the right to withdraw money from the country’s accumulated fund or consolidated Fund of India. Why and for what work will be withdrawn, it is mentioned in the budget.

- Finance Bill: All the provisions related to tax i.e. tax, delete or change in it are in this finance bill. The finance bill and the Appropiation bill are debated in Parliament. Many committees also consider them.

All these bills passing from Parliament are said to pass the budget.

Question 7: Why is the budget presented in the Lok Sabha itself, what is the role of Rajya Sabha? answer: It is necessary to allow the Parliament to deposit money in its treasury through tax etc. or to withdraw a pie from it. Permission of the Lok Sabha specifically.

This is the reason why the budget is presented in the Lok Sabha itself. After passing from here, the budget also goes to the Rajya Sabha, but if the Rajya Sabha suggests any change, then the Lok Sabha is not obliged to accept it. That is, if a government does not have a majority in the Rajya Sabha, it does not have difficulty in passing the budget.

,

Graphics– Ajit Singh